First Time Home Buyers, 2025

First time home buyers in 2025 have some really great opportunities to begin investing in themselves and their future. Putting down strong roots, putting your monthly home payment back into yourself, instead of an investor, is critical to building future wealth! In future blogs, I'm going to be expl

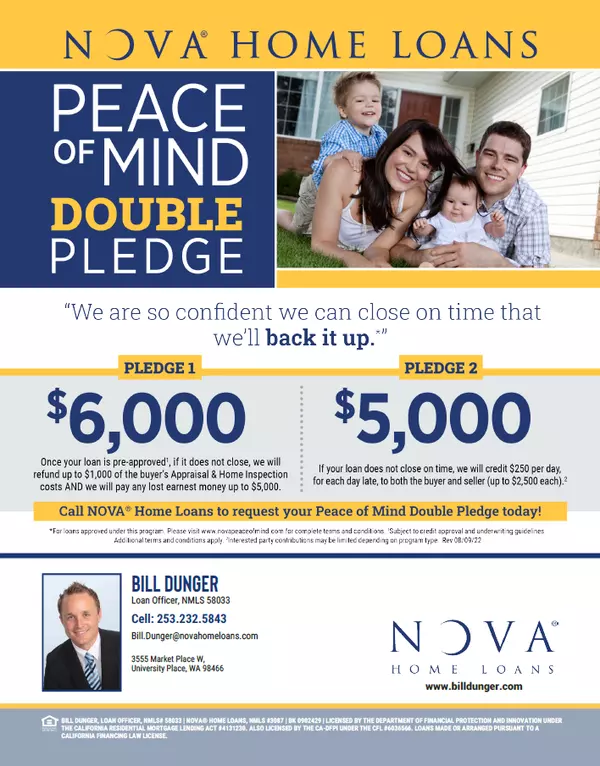

Kitsap County Renters

As a renter in Kitsap County, you may be wondering if it’s time to take the leap into homeownership. With the help of local experts like Bill Dunger from Bill Dunger, Nova Home Loans and Kari Green, Advisor, you can learn about the home buying process, mortgage options, and even some unique opport

Recent Posts

Sherry's Caffe and Bakery (Formerly Nostalgia House)

Kitsap Lenders Weigh In!

First Time Home Buyers, 2025

Mortgage Rates have come down!

Real Estate Settlement... what does in mean for Kitsap?

Story of a Lifetime-Luxury Home Spotlight, Vashon Island, Washington

Story Time: Historic Homes, Lafayette, Bremerton, Wa

Kitsap County Renters

Renters... What is YOUR interest Rate?