Mortgage Rates have come down!

In recent months, the real estate landscape has experienced a significant shift that has left many buyers and sellers feeling optimistic about their prospects. With the Federal Reserve's decision to slash interest rates, the mortgage market has seen a welcome decline in rates, creating a ripple effect that benefits both parties in the real estate transaction.

For buyers, this change is particularly advantageous. Lower mortgage rates translate to more purchasing power, allowing prospective homeowners to afford homes that may have previously been out of reach. For instance, a decrease in interest rates can mean lower monthly payments on a mortgage, which can make a substantial difference in budget considerations. This newfound affordability could allow buyers to consider larger homes or properties in more desirable neighborhoods, enhancing their overall quality of life.

Moreover, with increased buying power comes greater competition among buyers. As more individuals enter the market eager to take advantage of these favorable conditions, sellers will likely see an uptick in interest for their properties. This surge in buyer activity can lead to quicker sales and potentially even bidding wars, as multiple parties vie for the same home. Sellers who have been hesitant to list their properties due to previous high-interest rates may now find it an opportune time to put their homes on the market.

The current climate is also encouraging for sellers who have been waiting for the right moment to sell. With lower mortgage rates attracting more buyers, sellers can expect a broader pool of interested parties. This increased demand can lead to higher sale prices and faster closings, making it a win-win situation for those looking to sell their homes.

Additionally, with lower rates making homeownership more accessible, we might witness a shift in demographics within the housing market. First-time homebuyers are likely to be particularly active during this period as they seize the opportunity to enter the market at a time when affordability is improved. Young families and individuals looking to establish roots may find this an ideal moment to make their dreams of homeownership a reality.

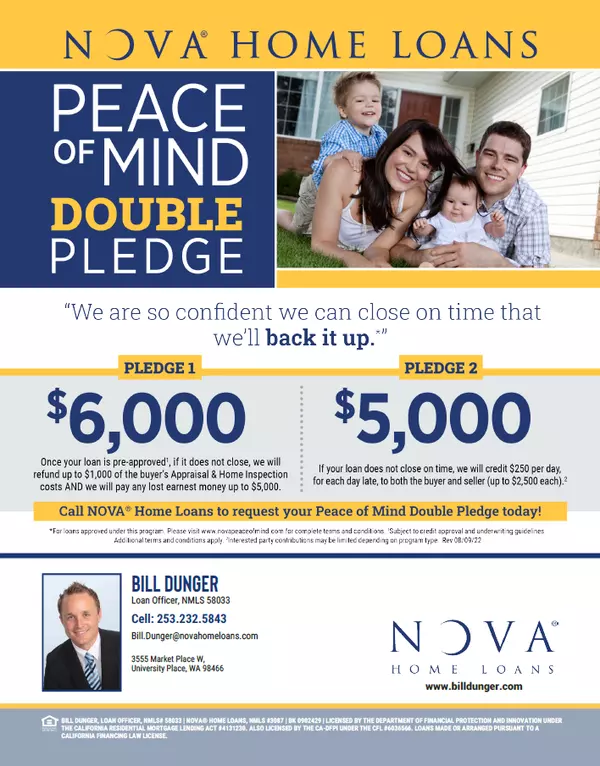

However, while there are many positives associated with falling mortgage rates, it’s essential for both buyers and sellers to remain informed and strategic about their decisions. Buyers should take the time to understand how different loan products work and what rate options are available based on their financial situation. Consulting with mortgage professionals can provide clarity on how much they can afford and what monthly payments will look like over time.

On the other hand, sellers should be aware of how market dynamics shift with increased buyer activity. While it’s tempting to list at a higher price due to heightened demand, it’s crucial not to overprice a property. Conducting thorough research or working with a knowledgeable real estate agent can help determine competitive pricing strategies that attract serious buyers while maximizing profit.

As we navigate this evolving landscape together, it's worth noting that while lower mortgage rates create opportunities, they also come with some uncertainties. Economic factors such as inflation and employment rates can influence future interest rate adjustments by the Fed. Therefore, both buyers and sellers should keep an eye on these developments as they plan their next moves in real estate.

In conclusion, falling mortgage rates present an exciting opportunity for both buyers and sellers in today’s real estate market. Buyers can enjoy enhanced purchasing power and access more desirable properties than before. Sellers stand to benefit from increased demand and potentially quicker sales at favorable prices. By staying informed and strategically navigating this changing environment, both parties can capitalize on these trends effectively.

As we move forward into this new chapter of real estate dynamics shaped by lower mortgage rates, it’s essential for everyone involved—whether you’re buying your first home or selling your long-time residence—to stay proactive and engaged in the process. With careful planning and consideration of current market conditions, you’ll be well-positioned to make decisions that align with your goals and aspirations in the realm of homeownership or investment.

Recent Posts