First Time Home Buyers, 2025

First time home buyers in 2025 have some really great opportunities to begin investing in themselves and their future. Putting down strong roots, putting your monthly home payment back into yourself, instead of an investor, is critical to building future wealth! In future blogs, I'm going to be exploring some of our great, first time home buyer neighborhoods and options! It's a great time to build your knowledge about the area, manage expectations on a first home, and be clear about how to move forward!

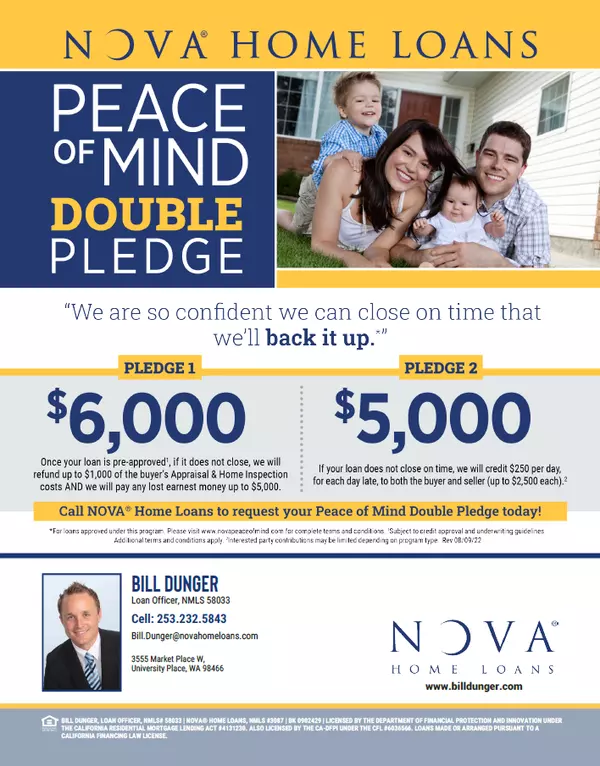

Today, we are going to discuss financing for our first time clients. I work closely with several lenders, who have proven themselves to be service oriented, ready and willing to do the work that needs done, to get my clients' offer accepted, and closed, as soon as possible! Each of these lenders brings something unique to the table, from credit repair resources, to ivnestments, I have the opportunity to match my clients with lenders, who I know will do everything they can for my people!

One of the most daunting parts of purchasing a first home is the search for a lender. There is SO much noise on-line, and all the ads act as if they are the ONLY way to go! The first thing to consider is the difference between a PRE-APPROVAL and a PRE QUALIFICATION.

Generally speaking, a pre-qualification is taking some basic information, given by the client, that shows whether or not that basic information could get you pre approved for a mortgage loan. These numbers and declarations in a pre-qualification, generally are not verified by the lender. This is a snapshot of what you MAY be able to qualify for... PRE-QULAIFICATION. Many agents won't write an offer on a pre-qualification, as there is no verification, and if the numbers are incorrect, the deal could fall apart last minute. Most seller agents would counsel their seller to wait on a stronger offer, with a lender verified pre-approval letter.

A pre-approval has gone through all the verification steps, the lender has verified all the information, income, assets, debt-to-income, and has offered a PRE-APPROVAL. This is a much stronger document than a pre-qualification, and is a minumum that agents look for in their offers.

A couple of my lenders take it a step further, and gets the approval letter through underwriting. This is one step beyone the verification, and says that the loan has already been fully vetted, and lender backed, with conditions, for example, a qualifying home. One of those lenders is Ariel Zufelt, with Future First Mortgage. She offers their Fast Track Approval program, getting our first time home buyers fully underwriteen and ready to go before they even make their first offer. When it comes to negotiation time, it is a great asset to be able to have the lender add a letter, stating that our client is fully underwritten and ready to go. It's a powerful tool, that helps the offer rise to the top.

Another really great thing about these strong pre-approval letters is swift closing time. My average for closing is 20 days. Typically, closing times are between 30-45 days. While there are other factors, including the title and escrow company, if the lender can be ready in 20 days, we can get it done!

Ariel is one of my favorite lenders. She takes care of my clients with the same care, consistency and relationship that I have. She gets the job done, has a significant amount of knowledge and understands the lending process very well. If you are a first time home buyer, let's get together, and build your personal Home Team!

Give me a call, and let's have coffee!

Recent Posts

Sherry's Caffe and Bakery (Formerly Nostalgia House)

Kitsap Lenders Weigh In!

First Time Home Buyers, 2025

Mortgage Rates have come down!

Real Estate Settlement... what does in mean for Kitsap?

Story of a Lifetime-Luxury Home Spotlight, Vashon Island, Washington

Story Time: Historic Homes, Lafayette, Bremerton, Wa

Kitsap County Renters

Renters... What is YOUR interest Rate?